Jaiz Bank Plc, Nigeria’s pioneer non-interest Bank, has announced its unaudited results for the six months ended June 30, 2023 with a Profit After Tax (PAT) of N3.9 billion.

In a statement released to the Press yesterday, the Bank declared that it had recorded a 51. per cent increase in its PAT when compared with N2.4 billion recorded in the corresponding period ended June 2022. This implied a net profit margin of 27.3 per cent within the top-bracket of the industry margins.

The half year results show gross income risen by 41.9 per cent to 20.3 billion against 14.3 billion recorded for the corresponding period ended June 2022.

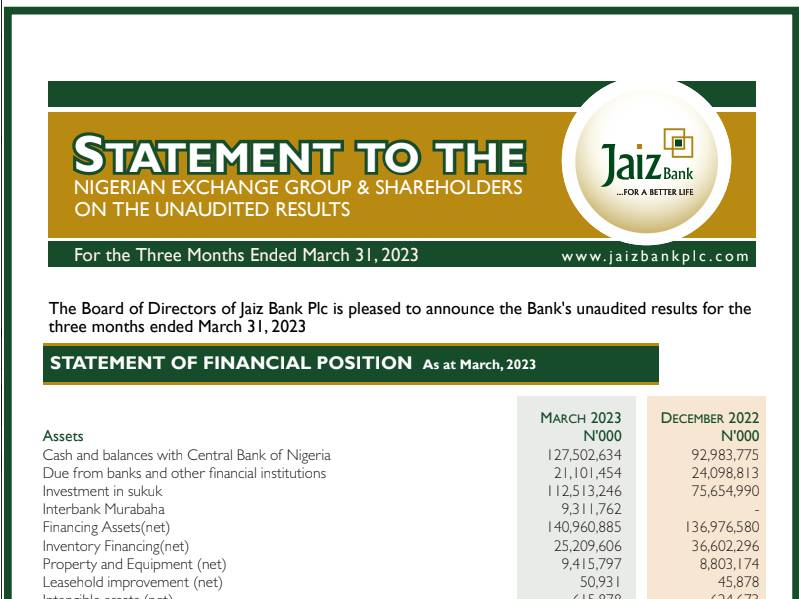

The Banks balance sheet remain well-structured and robust closing at 452.8 billion in H1’2023 compared 379.8 billion in H1’2022 representing 19.2% increase. Deposit Liabilities increased by 28.8 percent from 299.4 billion recorded as at December 2022 to 375.3 billion in June 2023.

While the earnings per share rose by 54.9 per cent from 7.34 kobo to 11.3 kobo when compared with the corresponding period ended June 2023.

The results show an increase in key revenue lines and a strong performance in other financial metrics which reinforce the Bank’s growth prospects as the leading Non Interest Bank.